In both 2018 and 2019 we saw a significant ramping up of online sales in Quarter 4 (Q4). In both years, Q4 transactions were 12% up on the year before. The growing hype around grabbing a bargain saw even more shoppers flock online, buying more items and spending more each time. More discounted products offered by more retailers, across an ever growing range of sectors, is also a big contributor to this growth.

While transaction growth was similar, there were some notable differences between 2018 and 2019. In previous years, sales peak was around Christmas week but last year we saw the peak move much earlier, with Black Friday spend $100 million more than Boxing Day. Just as important, Black Friday and Cyber Monday are no longer individual day sales, with big sales numbers in the days immediately before and after. Combined, we ended up with a period over late November to early December when Q4 sales numbers reached their peak.

The other trend evident in 2019 was the increased number of sectors benefiting from sales events. While traditionally we saw big growth in everyday consumer items like clothing, footwear and cosmetics, last year we saw a real lift in bigger-spend items like electronics and homeware. Partly, this was because these retailers were late in embracing these sales events but also because consumers have become more familiar, and confident, with buying more expensive items online.

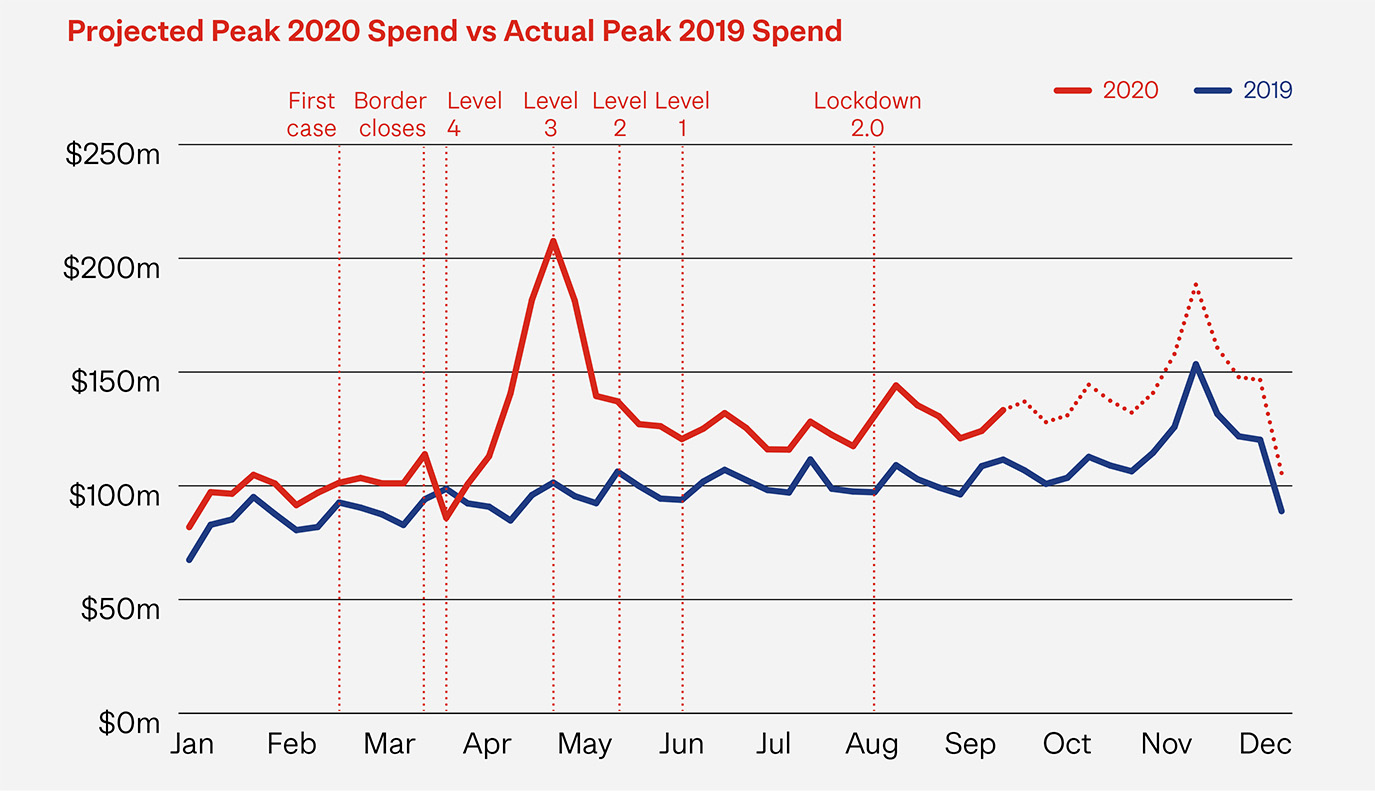

So given what we saw last year, and the difficult year that 2020 has been, what can we expect this coming Q4 period? The graph below shows what this may look like if growth this year follows a similar pattern to the last two years. November spending looks like it may approach the highs we experienced back in April.

Some argue that sales numbers should be higher than last year because we are starting from a higher base with many more shoppers already online and already aware of event days. Expectations have been growing and more shoppers have been waiting for these peak events before buying certain items. With less travel and eating out this year, an increase in discretionary spend could see further growth in higher-ticket items through this period.

On the other hand, there is a recession and what history tells us is that shoppers cut back on non-essential spend. In theory, this means we should see less spend overall or at the very least spending focused in a smaller number of categories. However, even in the toughest time, buying Christmas presents is seen as essential, so we may see many of this years’ gifts purchased early during the event sales. It’s likely, many of purchases will be made using Buy Now Pay Later facilities.

Are you ready?

Whichever argument you subscribe to, there is little doubt that retailers will see a rise in sales over the next few months. The question is – will it be big, really big or huge? Whichever, we all need to get ready. We’ve started. We’re planning for around 16% growth in parcel volumes and gearing up our network for the increased delivery volumes this will bring.

For many retailers a large proportion of their annual revenue comes through this period, and for those who’ve been heavily impacted by COVID-19, this year’s peak period may be even more important than ever. The first thing is ensuring you have stock ready to manage orders throughout the period and also have plans to manage customers’ expectations about when orders will be filled.

While increased revenue and cashflow is welcome, the big challenge for retailers over peak is the impact on profit. Professor Jonathan Elms, from Massey University Business School, sees event days being about exposure. He encourages retailers to see this period as an investment in the future of their business. Sales events can help attract new customers in existing markets and to bring new markets to your brand. He says “the real opportunity is to turn these into long-term loyal relationships built on something other than a discounted price.”

Achieving this means ensuring that a good initial experience with you, is followed up with further information and offers that become more personalised, building an authentic connection between that customer and your brand.

Elms says “despite the big volumes and lower margins, mobilise the whole team to ensure the shopping experience is the best it can be for new customers.”