Kiwi shoppers spent over $6.09 billion online in 2024, 5% more than in 2023. Despite the tough economic conditions, which saw overall retail spending decline, shoppers made online transactions – both locally and internationally - in record levels.

Key online shopping trends in 2024

- Shoppers purchased online more often, driving record transaction volumes

- Drop in average spend per transactions, as shoppers sought value

- Spending growth across almost all sectors and regions

- Local spend dominates, but international retailers are increasingly disrupting

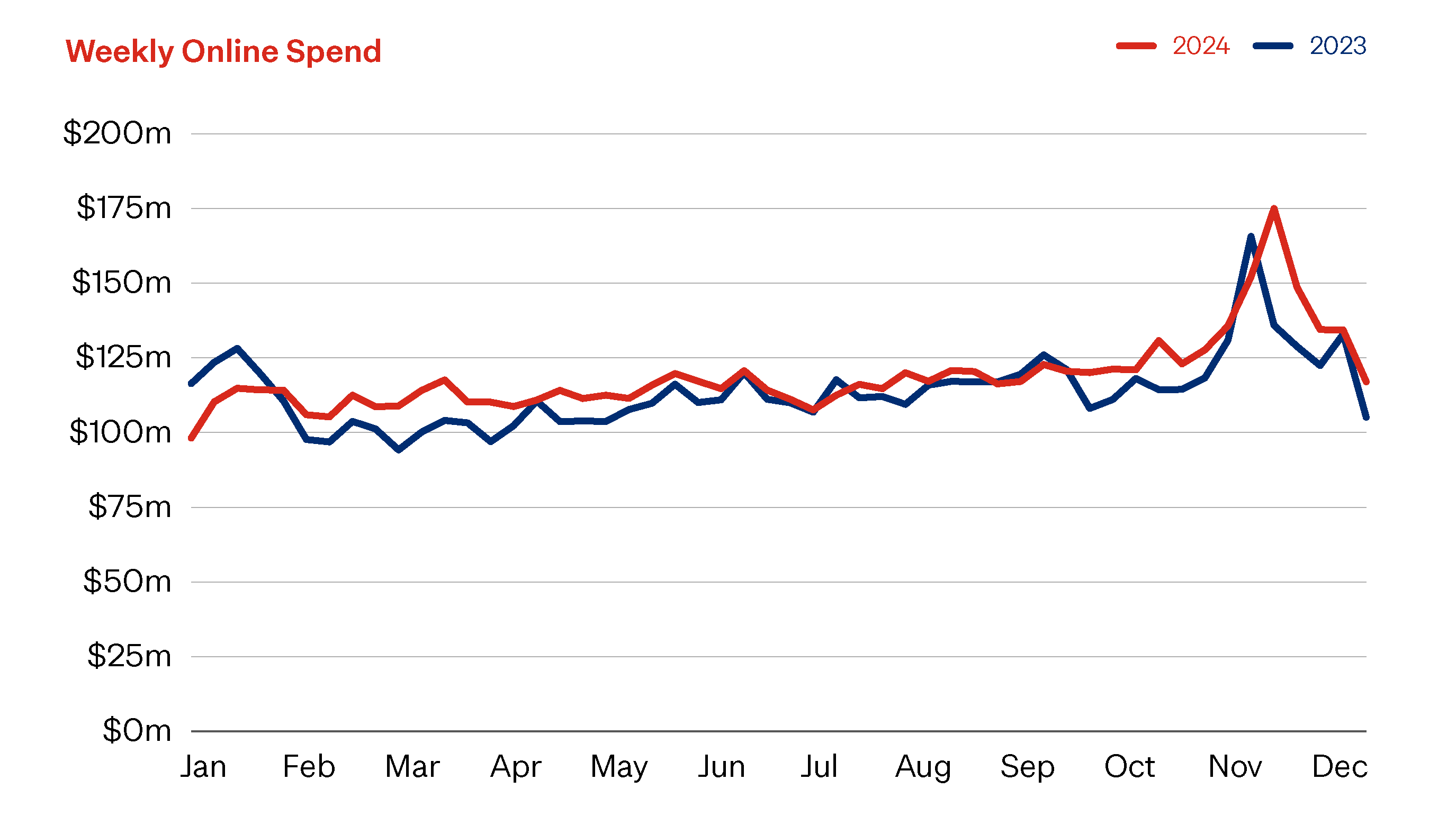

2024 was the second-highest year for online spending since we started monitoring eCommerce trends in 2019. Only 2021 was higher, a year which saw physical stores closed for long periods due to COVID restrictions, giving online shopping an additional advantage.

Given the overall decline in retail spending and a year characterised by high inflationary pressure, lower purchasing power, numerous job cuts and business closures, this is a significant result. It reinforces the important role online shopping plays in how Kiwi households manage tough conditions and in creating a more resilient local economy.

Shoppers responded to 2024’s difficult conditions by adapting their spending patterns, using online to make their money go further. As a result, 2024 saw shoppers buy online more often – with nearly 8 million more transactions than in 2023 – to reach transaction volumes that even exceed COVID lockdown times. Many online retailers experienced a busy year but this didn’t necessarily translate into bottom-line results, as shoppers spent less per transaction by choosing lower-cost alternatives and discounted products.

Kiwi shoppers continued to give priority to spending with local online retailers, with 72% of online spending with NZ-based businesses, unchanged from 2023. Despite local spending dominating overall, low cost overseas retailers, like Temu and others who invested into marketing to attract Kiwi shoppers, had a big impact on where Kiwis shopped last year.

In 2024 online transactions from offshore retailers grew at a faster rate (+16%) than domestic transactions (+12%), compared to 2023. However, the online average spend per transaction (average basket size) for offshore retailers fell at a faster rate (-10%) than domestic retailers (- 6%). These numbers suggest Kiwis are increasingly looking to overseas online retailers for lower priced products.

Instore spending reached $50.47 billion, 2.5% down on 2023, reinforcing the significant commentary about just how tough 2024 was for business owners in the retail sector.

Combined, total retail spending - online and instore - was $56.56 billion for 2024, down 1.7% on the year before. Online represented nearly 11% of total retail spending in 2024, up from just over 10% in 2023.

2024 retail spending (compared to 2023)

Online Spending $6.1b▲ 5% | Instore Spending $50.5b▼ 2.5% | Total Retail Spending $56.6b▼ 1.7% |

The drivers of online spending in 2024

The 5% growth in online spending in 2024 was primarily driven by a 13% increase in online transactions, partially offset by a 7.5% decrease in the average online spend per transaction (average basket size). With general annual CPI inflation at 2.2%, this represents real growth in shopping spend, not just shoppers paying more to buy the same items.

- TRANSACTIONS: There were more than 64.1 million online transactions in 2024, up 13% on 2023. On average there were around 175,000 online transactions every day during 2024.This is the highest number of annual online transactions we’ve seen since we started monitoring markets 6 years ago. For context, there were 42% more online transactions in 2024 than COVID-impacted 2020.

- AVERAGE BASKET SIZE: The average online shopping basket was $95 in 2024, down $7.66 on 2023. Shoppers were clearly cautious with their spending, spreading their money over more transactions, prioritising essential items, and opting for discounted products and lower-cost alternatives.

- ONLINE SHOPPERS: Nearly 2.2 million Kiwis (about 50% of the population aged 15 and over) shopped online in 2024. In general terms, there were more people shopping online in most months in 2024, compared to the equivalent month in 2023.

Buy Now Pay Later arrangements were also a big part of how online shoppers were able to spend more in 2024’s conditions, resulting in 19% growth in the total value of online Buy Now Pay Later transactions compared to 2023.

What Kiwis bought online in 2024

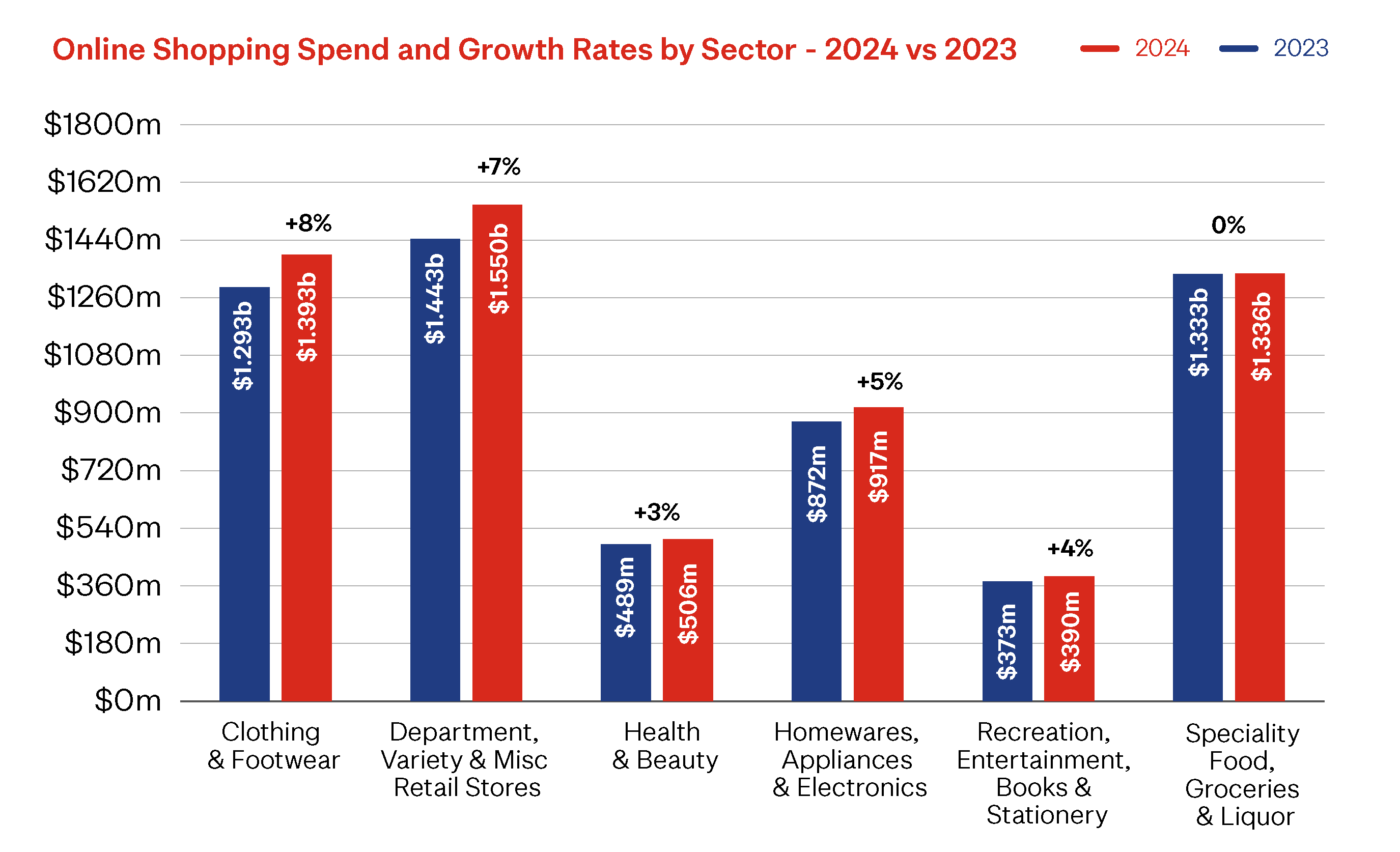

Online spending grew across nearly all sectors compared to 2023, driven by growth in transaction volumes in all sectors. Four of these sectors saw this transaction growth come from domestic retailers while international transaction volumes declined.

Department, Variety & Miscellaneous Retail stores had the fastest growth rate in international transactions (+33%), reflecting the disruptive impact of stores like Temu on Kiwis’ shopping habits. The other sector that saw international transaction growth was Speciality Food, Groceries & Liquor (+9%), suggesting the products sourced from overseas aren’t available here.

The average basket size fell for all sectors, except for Recreation, Entertainment, Books & Stationery which remained the same overall. This sector’s domestic basket grew by 7%, with the international basket size falling by the same amount.

- New Zealand’s two largest online retail sectors, Clothing & Footwear (up 8%) and Department, Variety & Miscellaneous Retail (up 7%) had the fastest spending growth rates compared to 2023.

- Clothing and Footwear's growth was driven by a strong increase in domestic spending (+20%) at the expense of offshore spending (-17%). The sector’s domestic transaction levels were a massive 32% up on 2023, partially offset by a 9% decline in the domestic basket size.

- Growth for Department, Variety & Miscellaneous Retail Stores, New Zealand’s largest online retail sector, was dominated by overseas spending in 2024. Overall there were over 3 million more transactions in the sector compared to 2023. 55% of the sector’s transactions were with offshore retailers, compared to 47% in 2023. The average online basket size fell for both offshore and domestic retailers.

- Speciality Food, Groceries & Liquor was the only sector that didn’t see growth in online spending. While overall sector spending was flat, the Grocery Stores and Supermarkets sub-sector did have growth, suggesting people are searching online for better prices on every day household essentials. This sub-sector’s growth was however matched by declines in non-essential spending in the Liquor Stores, and Convenience Stores & Specialist Markets sub-sectors. Prioritising essential, over discretionary, spending is a trend we’ve seen throughout 2024.

- The remaining three sectors saw online spending grow by between 3% and 5%.

By comparison, instore spending fell across all sectors in 2024 except for Health & Beauty, which saw a 3% rise.

2024's Regional Trends

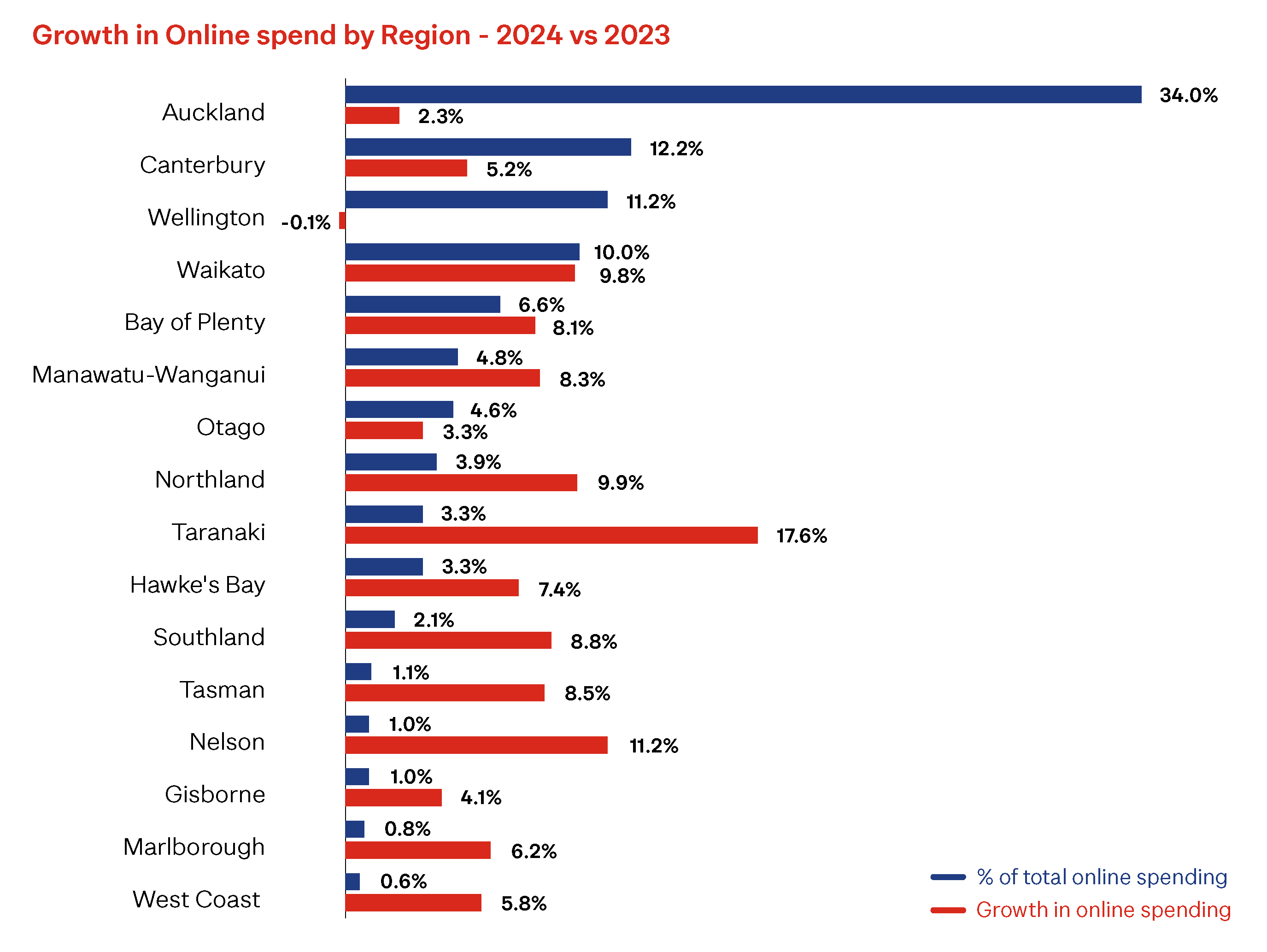

Online spending growth for 2024, compared to 2023, was largely positive across the regions, fuelled by online transaction growth in all regions. There was no clear distinction between the North and South Islands or urban and rural areas.

The largest growth in online spending was in the Taranaki (+18%), driven by the fastest growth in online transactions (+31%). Taranaki represents just 3% of online spending in New Zealand.

Online spending growth was also strong in Nelson (11%), Northland (10%) and Waikato (10%). Interestingly, these areas experienced some of the highest rates of instore spending declines in 2024, suggesting shoppers switched some of their instore spend to online.

Auckland, which accounts for over a third of New Zealand’s online spending, saw online spending increase by a modest 2%. It fared better than Wellington though, which was the only region to experience a decline in online spending. This is the second year running that online spending in Wellington has declined. Cost-cutting in the public sector, and the associated uncertainty surrounding job losses, are thought to be the primary drivers of this.

In sharp contrast to online’s regional growth, instore spending decreased across all regions when compared to 2023.

Who purchased online in 2024

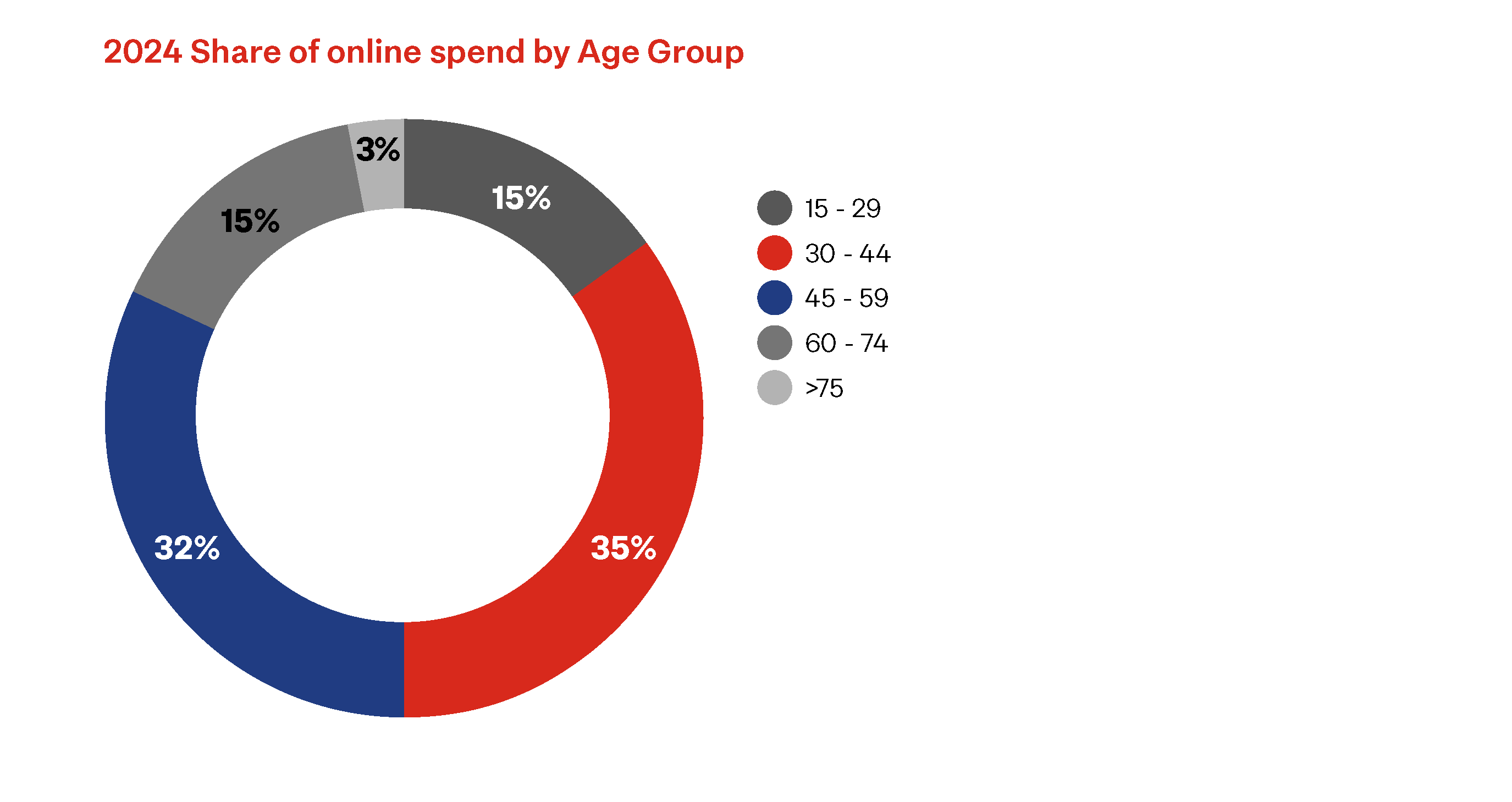

Not surprisingly, online spending continues to be dominated by the age group with the most discretionary income (30-59), though it’s the older age groups (60+) who are experiencing the largest percentage growth in spending.

Looking ahead to 2025

The catch phrase over the last year was ‘survive to 2025’ suggesting that 2025 would be the answer to all of 2024’s difficulties.

The general consensus now from economists and other market commentators is that 2025 will show some improvement but is unlikely to deliver the big upturn shoppers and retailers have been waiting – and hoping – for.

General inflation is down to more manageable levels, cash and associated mortgages rates have dropped, with further downward movement expected. These positive economic drivers are balanced by negatives like high unemployment, rising council rates and rental costs, and limited GDP growth expectations. Add to this the Trump uncertainty factor and two global conflicts, and it’s clear foreign pressures will continue to have a big say on what happens locally. Overall most commentators are forecasting household spending to remain weak and consumer confidence to be low until later in 2025.

Shoppers will keep adapting their behaviours in accordance with their situation, tightening their spending if their perceived job security and purchasing power remains low or spending more as they benefit from better mortgage rates. In both scenarios, shoppers will keep looking online to compare prices and to seek greater value, offering further opportunities for online retailers in 2025. No doubt, shoppers will continue to look overseas, to retailers like Temu and Shein, for lower prices, especially as these retailers have improved their delivery times and costs and continue to invest in marketing.

Retailers will need to show the same flexibility as shoppers, adjusting their approach to align with their own financial position and the changing needs of their customers. The last 5 years have shown us just how resilient and adaptive retailers can be. We think these will be skills that will serve them well in 2025 as they prepare for better times ahead.

NZ POST HELPFUL HINT

Take a long-term view. Delivering what your customers value will help you retain and grow existing customers and attract new ones. While discounts and other incentives will support your short-term revenue and cashflow efforts, 2025 should also be the year you deliver a better overall experience for your customers. Turn customers into advocates and fans by reviewing and enhancing every customer touchpoint - from your website through to delivery.

How we can help

We’re passionate about helping you grow your online business, through the tough years and beyond. Talk to us about what you need and how we can best deliver it for you. https://www.nzpostbusinessiq.co.nz/how-we-can-help

The data used in this eCommerce Spotlight is card transactional data supplied by Datamine. We are continually reviewing and refining our methodology to bring our readers the most relevant and accurate information possible. At times, as we update our approach, this creates some discrepancies with previously published information. While we don’t go back and adjust earlier published information, when comparing current information with past periods we use consistent like-for-like methodology.