The fourth quarter (October - December) is generally the most important in an online retailer’s calendar, with a significant lift in spending over the previous three quarters. In 2023 nearly 28% of the whole year’s online spending occurred in the last quarter of the year (Q4 2023). This Peak sales season starts at Labour Weekend and lasts through to the end of the year, and into the new year.

2024 has been a tough year for retailers and shoppers alike. The economy has seen shoppers focus on essential spending, searching for bargains and generally finding ways to make their money go further. Q4 2024’s big sales events, and the lead into Christmas, represents the perfect opportunity for online retailers to end the year strong.

Let’s get ready to make the most of the upcoming Peak season sales opportunity. In this article we explore the trends from recent years that help us plan for this year.

Lessons from Q4 2023

Like each of the last five years, Q4 2023 was the biggest online spending quarter for the year, as Kiwis ramped up their shopping during the November sales and through to Christmas. We saw online spending reach $1.6 billion, up 5% on the year before and well ahead of the growth experienced in-store.

Q4 2023 vs Q4 2022

Online Spending $1.6b▲ 5% | Total In-store Spending $14.4b▲ 2% | Total Retail spend $15.9%▲ 2% |

- Shoppers bought more often: over 16 million transactions in Q4 2023, 2.4 million more (17%) than in Q4 2022.

- Shoppers spent less each time: the average online transaction was $12 less (11% lower) than the year before.

- There were more online shoppers: with shopper numbers over the quarter up 4% on the year ago.

HELPFUL HINT

Prepare for more sales and more shoppers. Ensure you have the stock and staff for higher volumes and make sure your infrastructure (website, fulfilment and delivery, customer service process, etc) is ready for more activity in Q4.

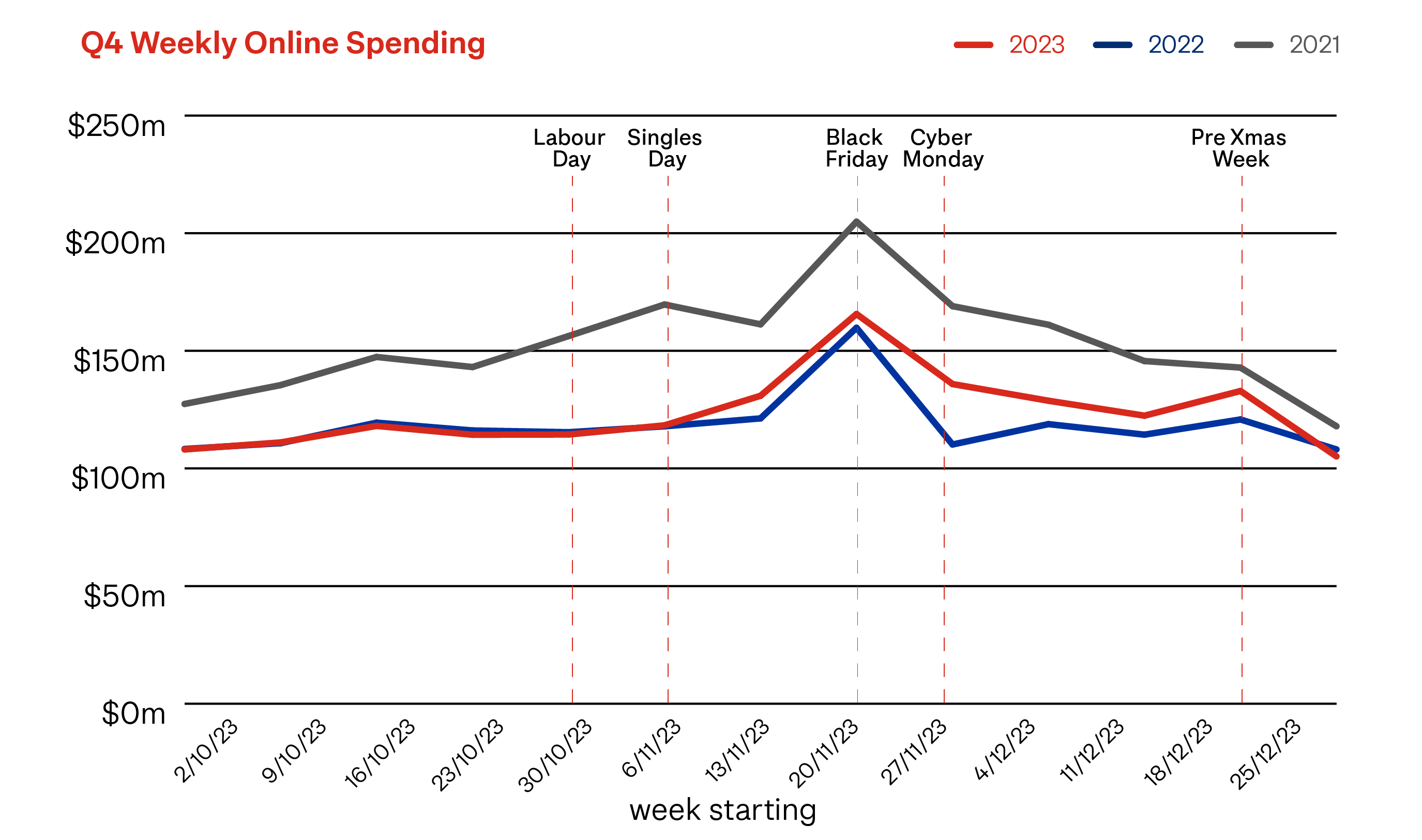

Sales start earlier and last longer

Historically, Q4 is characterised by a steady climb in online spending through October, followed by a sharp increase around Black Friday/Cyber Monday. This is followed by a gradual decline as Christmas approaches, with a mini-peak just before Christmas, when people rush for those last-minute gifts and festive supplies. We can expect these sales trends to look very similar this year.

We’ve been tracking this data for over five years now, and retailer sales events seem to start earlier and earlier. Over the past two years we’ve seen Labour Weekend mark the start of Peak.

An increasing number of retailers treat the quarter as an extended sales period, rather than the series of individual sales events. In 2003, Labour Weekend deals quickly become Black Friday sales which carried through to December, re-labelled as Christmas sales. We then saw many of these same sales extend into January, rebranded as New Year or Summer sales.

HELPFUL HINT

Make a Q4 promotional plan. With an extended promotion period, a well-considered marketing plan for all Q4 is essential. Be ready to go from late October and for sales to ramp up through November.Check out our guide for preparing for sales events.

Key Retail Event Dates

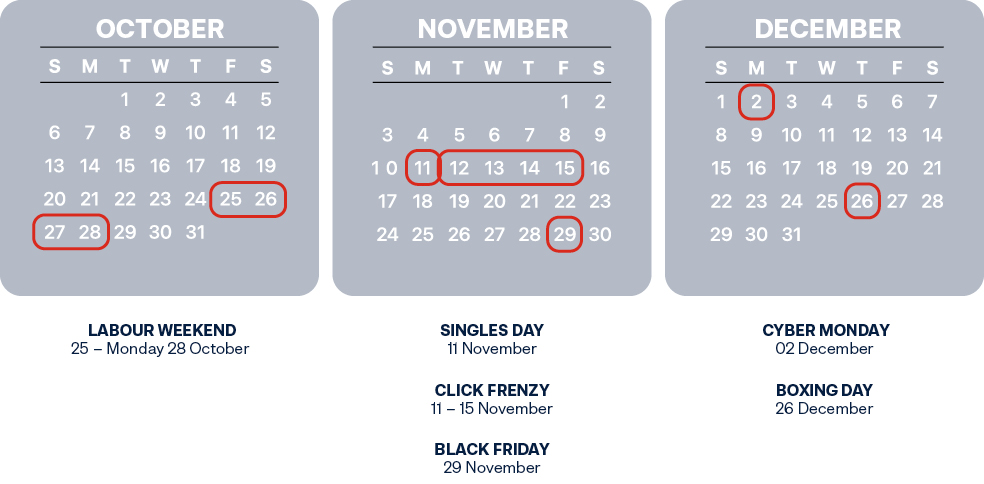

- Labour Weekend Sales, Friday 25 – Monday 28 October, is the official start of the Peak season. It’s an annual public holiday to recognise the achievements of workers. It appears workers enjoy celebrating it by spending their hard-earned money on bargains.

- Singles Day, 11 November. Originally started in China, Singles Day is an unofficial holiday for those who aren’t in relationships. Its quickly become a global event and a good excuse for retail therapy – for both singles and couples! Last year’s Singles Day saw Kiwis spend over $12.3m online in just that one day.

- Click Frenzy, 11 November to 15 November, is an online sales initiative based on a similar US format. It’s our newest online shopping event and it has been growing year-on-year. This will be the fourth year of Click Frenzy in New Zealand.

- Black Friday, 29 November. The day after Thanksgiving, celebrated in the US, made its way into the global retail calendar. Why is it called Black Friday? Traditionally it was such a big day of retail spending, that many US retailers turned their year-to-date loss into a profit – moving from the red into the black.

- Cyber Monday, 2 December is considered Black Friday’s sister shopping holiday. It occurs on the Monday after Thanksgiving and was created by retailers to encourage shoppers to shop online.

- Boxing Day, 26 December was named to reflect the ‘boxing up’ of items the rich gave to the poor after Christmas. These days it marks the start of the summer sales allowing retailers to get rid of excess Christmas stock while capatalising on the extra time and goodwill shoppers have around this time.

Last year saw over $88m in spending for the Black Friday – Cyber Monday four-day period.

HELPFUL HINT

Make a great delivery experience the reason why shoppers choose you during Sales Events. Shoppers want visibility in their delivery experience that gives them confidence that their item will arrive when you said it would. Creating a great delivery experience will attract new customers, retain existing ones and drive higher levels of customer satisfaction. Check out our 10 Tips for Delivery Excellence in Peak and Beyond

The Christmas, Boxing Day and New Years Peak

The Wednesday before Christmas (20 December) was the single largest online spending day in 2023 with over 226,000 transactions delivering $27.7 million in online spend. This ‘largest day’ often coincides with the last day for getting parcels delivered for Christmas.

Going to the Boxing Day sales has been a long held Kiwi tradition that has transcended to the online world. On Boxing Day 2023 online spending was $16.1 million – up 20% on 2022. There were over 152,000 online shopping transactions completed in just one day.

Most years we see the Boxing Day sales continue into the new year, and that was particularly noticeable last year. Many retailers instantly switched out their Boxing Day sales into New Year sales, driving additional big shopping days late in the year and through January 2024.

KEY CHRISTMAS SENDING DATES

To have the highest chance of getting parcels delivered before Christmas:

- Courier (Overnight) – Friday 20 December 2024

- Economy – Wednesday 18 December 2024

- Domestic Mail – Tuesday 17 December 2024

Please note: Express service is available from Saturday 21 December and operates over Christmas to ensure special deliveries reach their destination. Businesses operating internationally have a separate set of dates, we will be in touch directly about these.

Looking ahead to Peak 2024

In our latest eCommerce Market Sentiments Report, we asked shoppers “When deciding which store to buy from online, where similar products are offered, what are the most important factors to you?” It’s not surprising in the current economic conditions, that discounts and special offers were what more than half of shoppers valued most. This drive for value-for-money has been shaping online shopping behaviours in the last two years and there is little to suggest anything will be different in the back half of 2024.

The economic environment will no doubt continue to be the biggest influencer of online shopping’s performance. While inflation is easing back, prices remain high. Most commentators forecast household spending to remain weak and consumer confidence low.

Leading economist, Shamubeel Eaqub, thinks things will get tougher for shoppers before they get better. “Most Kiwis have tightened their belts and are prioritising the things they need over the things they want. And things will get a bit tougher, as job losses creep up and people roll over to more expensive mortgages."

Despite the lack of short-term relief for households, Shamubeel feels optimistic about the future with resumption of Government investment, tax cuts flowing through and anticipated interest rate reductions likely to lift confidence by the end of the year.

In his view, the start of the economic upturn may be as soon as “the end of the next summer holidays.” In the meantime, he expects the upcoming Peak season to be as popular as ever with shoppers, creating a great revenue opportunity for retailers.

EXPERT OPINION

We asked Shamubeel Equabel what advice he has for retailers for the rest of 2024:

- Keep focused on delivering value for money to maintain your market share, market presence and to remain top of mind with your customers.

- An economic upturn is coming so use the next six months to get ready for better times. Ensure you have all the process and infrastructure in place ready to go at the start of 2025.

The data used in this article is sourced from eCommerce Spotlight The search for value continues. It is based on card transactional data supplied by Datamine. Online spend includes both international and domestic shopping and only includes physical consumer goods.