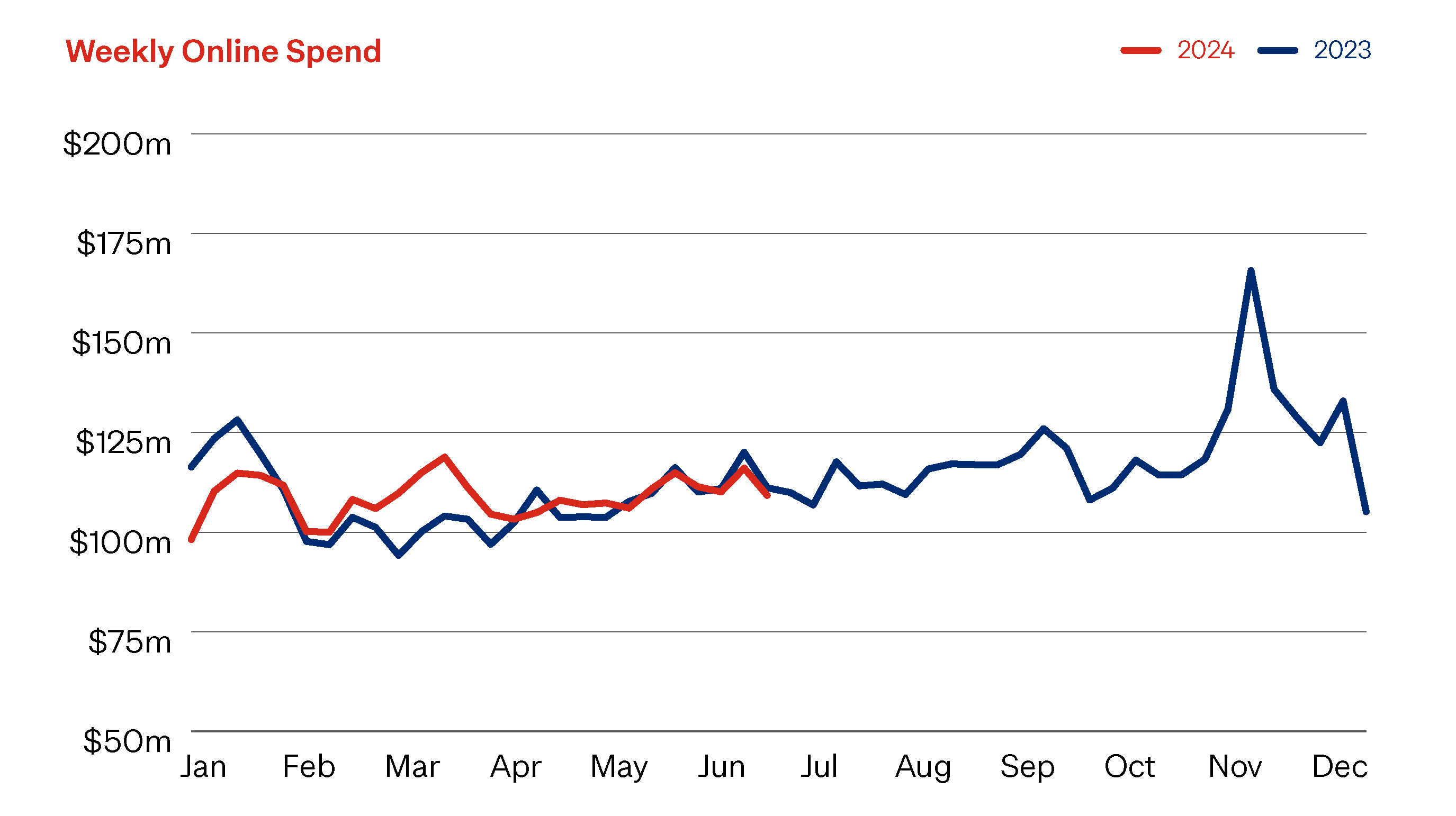

Kiwi shoppers spent $1.39 billion online on physical goods in the second quarter of 2024 (Q2 2024), up 1% from the same period last year (Q2 2023). This marginal growth in spending was driven by an 8% increase in the number of online transactions. This continues the trend we’ve seen since the start of the year, with shoppers looking online in search for value.

With recent positive economic indicators offering a glimmer of hope, can online retailers expect more of the same going forward, or better times ahead?

This quarter’s online shopping story is not a new one but a continuation of what we’ve been seeing for some time now, with ongoing tough economic conditions leading to tight budgets. Shoppers are looking to make their spending dollar go further by heading online to compare prices, search for value and get the best bang for buck. This flight to online is supporting both shoppers and online retailers to get through the tough times.

And while there is more online activity, online spending itself is flat. $1.39 billion was also the value of all online spending last quarter (Q1 2024), further reinforcing online’s flat trajectory this year.

For many shoppers the focus remains firmly on using their shrinking purchasing power on meeting essential needs, rather than spending on discretionary wants. Our recent eCommerce Market Sentiment Report showed that shoppers are actively looking to buy discounted items and/or cheaper alternative products.

Reduced shopping basket sizes also reflect how retailers have responded to changes in buyer behaviour. Many retailers have been discounting prices or promoting special offers for most of the last six months, or offering reward programmes with loyalty offers - encouraging shoppers to discount buy. Cashflow has been critical to retailers’ survival, with discounts giving them the revenue (albeit slightly reduced) they need to get through the tough times.

Q2 2024 vs Q2 2023

Online Spending $1.39b▲ 1% | In-store Spend $11.9b▼ 3% | Total Retail Spending $13.4b▼ 3% |

On a positive note for online retailers, online spending held up better over the quarter than physical retail spending, which was down 3% on Q2 2023. In-store transactions and the average basket size both fell – in-store transactions by 2% and average basket size by 1%. Our recent eCommerce Market Sentiment Report showed that shoppers are increasingly looking around for the best value. This quarter’s difference between online and in-store may further suggest that shoppers are moving between channels to find bargains.

The other good news for online retailers is that around three-quarters of online spending in Q2 2024 was with local retailers. It appears that, despite the rise of low cost international marketplaces, Kiwi shoppers remain committed to supporting local retailers through the good times and the bad.

HELPFUL HINT

Promote that you’re a Kiwi business. Our recent eCommerce Market Sentiments report showed that being a NZ based business was the third most likely reason to shop with a particular retailer. Kiwis want to support local businesses and our economy, and want to feel part of a local community. Besides loyalty and connection, shoppers feel more confident that local deliveries will arrive on time and this makes it an advantage when competing with international retailers.

The drivers of Q2 2024 spending

Three key factors drive online spending – transaction volumes, basket size and the number of shoppers online. In Q2 2024, growth was driven by transaction volumes, offset by the decline in the average basket size.

Transaction volumes ▲ 8%On Q2 2023 | Average basket size ▼ 6%On Q2 2023 | Online shoppers ▼ 0.4%On Q2 2023 |

- TRANSACTIONS: There were 14.4 million online transactions during the second quarter of 2024, 8% more than a year ago. In fact, this is the largest number of Q2 online transactions we’ve seen in the five years we’ve been tracking eCommerce markets.

- BASKET SIZE: The average spend per transaction (basket size) in Q2 2024 was $97, down $6 on Q2 2023. Shoppers were very selective about what, and how much, they bought, putting fewer and/or cheaper products in their shopping basket.

- ONLINE SHOPPERS: 1.55 million Kiwis (~36% of the population aged 15 and over) shopped online in Q2 2024. This was ~24,000 people fewer than Q2 2023.

HELPFUL HINT

Incentivise additional spending with additional value. Shoppers like discounts and special offers and are happy to spend a little more to get value-for-money. Offer a value price for buying in bulk, a discount for purchasing a second item, or free delivery for purchases over a certain amount. Make sure your offer delivers value to your customers and to your bottom line.

Q2 2024’s online sector and regional trends

Online spending across sectors was a mixed bag. Three sectors experienced growth over the year before, while three declined. And as we’ve seen for some time now, essential spending held up better than discretionary spending, as shoppers prioritised ‘need’ over ‘want.’

Q2 2024 vs Q2 2023

+6%Department, Variety & | +5%Health & Beauty | +3%Clothing & Footwear |

-1%Recreation, | -2%Homeware, Appliances & | -6%Specialty Food, |

Online spending changes were also mixed from a regional perspective, ranging from steady growth at one end, through to mild decline at the other.

Compared to Q2 2023:

- Taranaki experienced the largest growth in Q2 2024, up 9%.

- Auckland, Wellington and Nelson had the largest declines, down 2%.

Snapshot: Five interesting facts about 2024 so far (H1 2024)

- Kiwis spent $2.78 billion online in the first six months of 2024. This is 2% up on the same period in 2023.

- Online spending was flat between Q1 and Q2 but we saw Q2 transactions fall 4% on Q1 volumes.

- H1 2024 in-store spending fell by 3%, compared to the same period in 2023, driven down by both lower transaction volumes and a lower average basket size. In-store spending in Q2 2024 was 1% below Q1 2024 while transactions were 2% down.

- Four out of six sectors saw online spending growth in the first half of 2024 compared to H1 2023. Department, Variety & Miscellaneous Retail Stores was the sector that grew the most, up 9%. The two sectors that saw online declines were Speciality Food, Groceries & Liquor, and Recreation, Entertainment, Books and Stationery.

- Online spending increased, or at least held steady, in all regions except one. Wellington was the only region where online spending in H1 2024 fell compared to the same period in 2023. Job losses in the Government sector, and the anticipation of more, are thought to be the key driver behind Wellingtonians’ cautious spending.

Looking ahead to the rest of 2024

A tight economy in the first half of 2024 saw shoppers buy online more often but with lower levels of spend each time. Can retailers expect more of the same in the back half of 2024?

Recent falls in the annual inflation rate and signals from the Reserve Bank of a lower OCR ahead may start to offer glimmers of hope that better times are ahead for shoppers and retailers. Despite these signals, there’s little to suggest that things will be too different in the short term with prices, mortgage rates, insurance premiums, council rates and other household costs remaining high. Most commentators forecast household spending to remain weak for the rest of the year.

Leading economist, Shamubeel Eaqub, thinks things will get tougher for shoppers before they get better. “Most Kiwis have tightened their belts, prioritising the things they need over the things they want. Things will get a bit tougher, as job losses creep up and people roll over to more expensive mortgages."

Despite the lack of short-term relief for households, Shamubeel feels optimistic about the future with resumption of Government investment, tax cuts flowing through and anticipated interest rate reductions likely to lift confidence by the end of the year.

HELPFUL HINT

Get ready for better times in 2025. Leading economist, Shamubeel Eaqub believes the start of the economic upturn may be as soon as early 2025. He encourages online retailers to use the next six months to get ready for better times. Stay connected with your customers, get your infrastructure (website, fulfilment and delivery, customer service process, etc) geared for more volumes and start planning your promotional strategies to capture those buyers looking to purchase the things they haven’t over the last few years.

How we can help

We’re passionate about helping you grow your online business, through the tough times and better times ahead. Talk to us about what you need and how we can best deliver it for you. https://www.nzpostbusinessiq.co.nz/how-we-can-help

The data used in this eCommerce Spotlight is card transactional data supplied by Datamine. Online spend includes both international and domestic shopping, and is filtered appropriately to only include consumer goods. We are continually reviewing and refining our methodology to bring our readers the most relevant and accurate information possible. At times, as we update our approach, this creates some discrepancies with previously published information. While we don’t go back and adjust earlier published information, when comparing current information with past periods we use consistent like-for-like methodology.