Kiwis spent more than $2.2 billion on physical goods online during the first quarter of 2022. That’s 31% up on the first quarter of 2021 (Q1 2021) and a mammoth 86% up on the first quarter of 2020. Q1 2020 was the first quarter where we saw the impact of COVID on our shopping numbers with lockdowns driving people online from March 2020. Going back to Q1 2019, to get a true pre-COVID comparison, we see this quarter’s online spending numbers are more than double what they were just three years ago. This really captures the seismic shift that online shopping has gone through in such a short period of time.

Q1 2022’s numbers represent the second biggest quarter we’ve seen in online spending since we started reporting. Only the previous quarter (Q4 2021) was higher, reaching $2.5 billion. Q4 2021 had a number of sales drivers including big sales events (Black Friday, Cyber Monday, Click Frenzy, etc.) and the traditional Christmas rush. Furthermore, physical retail stores were closed or restricted for a large part of the quarter. As a result, the peak Q4 2021 online spend was up a massive 25% on Q3 2021.

Online spending in the first quarter of 2022 didn’t have these same drivers and, in fact, was subject to a number of headwinds like the human resource challenges caused by Omicron, a global conflict, further supply shortages and the rapidly rising cost of living.

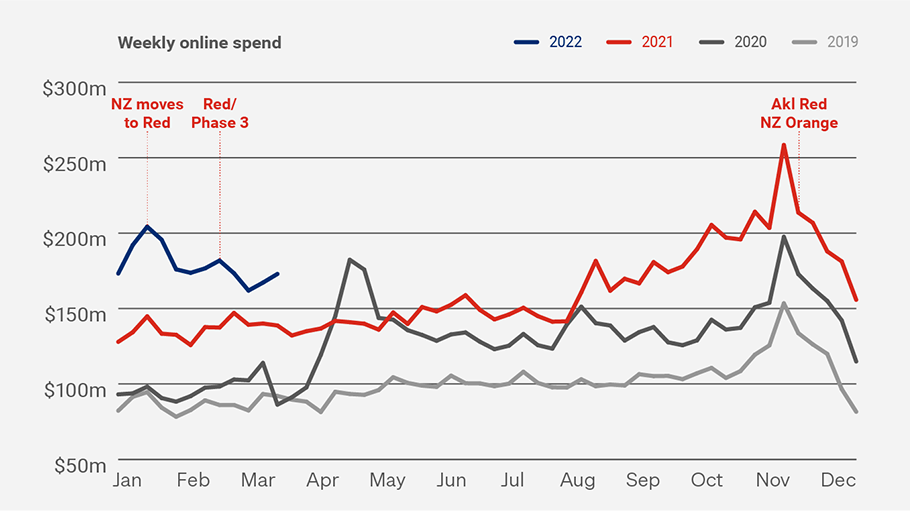

The fast spread of Omicron was greeted with elevated online shopping spend levels at the start of the quarter. The fear of an unknown new strain, a largely ‘unboosted’ population and strict isolation requirements saw online shopping continue as a smart choice. The close contact rule at the time resulted in many people isolating at home including entire classrooms, day care centres and businesses. For them the only way to shop was online. By late February, when the country moved to Red/phase 3, under the traffic light system, and the rules were less restrictive on businesses and shoppers, we saw weekly spend levels exhibit a steady decline. But even at these lower levels, they were well up on the same months of previous years, suggesting a significant long-term change in shopper behaviour has occurred.

Despite the declines in the back half of the quarter, Q1’s online spend didn’t lose all the big gain it made in the previous quarter, finishing only 12% down on Q4 2021.

Total retail spending for Q1 2022 - online and offline - was $16.4 billion, up over a billion dollars (7%) on Q1 2021. Some would argue that, with inflation running at 6.9%, much of this rise reflects rising prices rather than real growth. More than half of this increase comes from the uplift in online spending, showing what a key role online plays in keeping momentum going in our retail sector. Of course, the line between online and offline has become increasingly blurred with the growth of click and collect and other omnichannel shopper experiences.

Online spending made up 14% of total spending for the quarter, up from 11% in Q1 2021 and 8% in Q1 2020. We’ve seen online’s penetration remain at this higher level for the last three quarters, suggesting it's yet another area where a new benchmark has been set.

And while the quarter as a whole was up from Q1 2021 we can see a progressive monthly decline of both spending levels and the number of people shopping online throughout the quarter. This is the first time we’ve seen this in the last three years. We explore the relationship between Omicron and the quarter’s online shopper behaviours in the article 'Omicron bucks the trend'.

On a more positive front, Kiwis have been showing the love to local online retailers and this also hit a new high this quarter, with 77% of online spending with NZ-based businesses.

The drivers of growth

In each edition of eCommerce Spotlight, we look at the key factors that drive online spending – the number of shoppers online, how often they shop and how much they spend each time. Compared to Q1 2021, we see an upward shift in all these key factors, making it no surprise that online spending overall is up.

Quarterly Online Customers*

2.28mQ1 2022 |

1.97mQ1 2021 |

1.61mQ1 2020 |

Over 55% of the adult population (aged 15+) engaged in online shopping during Q1 2022. This continues the growth we’ve seen over the last couple of years. In Q1 2021, 48% of Kiwis aged 15 and over were online and that number drops to just 40% in 2020. And with nearly 84,000 first time online shoppers this quarter we can expect this number to keep rising.

Quarterly Online Transactions

16.9mQ1 2022 |

13.3mQ1 2021 |

10.2mQ1 2020 |

Over the last year, transaction growth has been the biggest contributor to overall online spend and it was a major factor again in Q1 2022. There were 16.9 million transactions online this quarter - an average of over 187,000 online transactions per day. Transaction levels were 27% up on Q1 2021, 66% up on Q1 2020 and nearly 70% up on the first quarter in 2019. There can be no doubt that online is becoming an increasingly popular way for Kiwis to do their shopping.

Quarterly Online Basket Size

$131Q1 2022 |

$128Q1 2021 |

$117Q1 2020 |

Basket size refers to the average amount shoppers spend online each time they transact. The average online basket size in Q1 2022 was $131.45, up $3.61 on a year earlier. While this could reflect that shoppers are becoming more comfortable to buy higher-value items online, it is just as likely a reflection of the rising cost of living.

Looking at the average online shopper* for the quarter we see that he or she made 7.2 transactions online. This is up from 6.4 just one year earlier. And their spend was $856, which is $115 (15%) up on Q1 2021 and a massive $232 up on two years earlier.

In short, there are more Kiwis shopping online and they are buying more often and spending more each time. This is a solid platform that should see online shopping continue to grow.

Q1 2022 Sector Highlights

-

The quarter’s big winners, compared to Q1 2021, were Homewares, Appliances & Electronics (up 38%), Health & Beauty (up 37%), and Clothing & Footwear (up 36%).

-

Health & Beauty had its highest quarterly spending and transaction levels since the start of 2019, driven by strong growth in ‘Drug Stores & Pharmacies’ and ‘Misc. Medical.’

-

Most of the remaining sectors saw growth in online spending above 25%, except Recreation, Entertainment, Books & Stationery which had a more modest growth of 12% compared to Q1 2021.

-

Buy Now, Pay Later continues its charge, up 51% compared to Q1 2021

-

Online spending through Marketplaces fell slightly compared to Q1 2021.

Regional Round-up

-

Compared to Q1 2021, the three regions with the fastest growth rates were: Marlborough (36%), Tasman (36%) and West Coast (35%). These are amongst the smallest regions for overall online spending.

-

Auckland’s annual growth slowed following a strong Q4 2021, as the region came out of lockdown and restrictions. Online spending was $789.6 million, 29% higher than Q1 2021.

-

Auckland contributed 36% of national spending, the same as Q1 2021 and about the same as pre-pandemic Q1 2019.

Demographic Trends*

Looking at a sample representing 90% of shoppers aged 15+, we see that:

-

The age group with the fastest growth rate (40%) in online spending was the 75+ group, however their spending represents only 3% of total online spending.

-

Most age groups had growth above 30% from Q1 2021 to Q1 2022. This figure was relatively consistent across both spending and transaction growth.

-

For the 15-29 year age group, Q1 2022 spending was 31% higher than Q1 2021. This outpaced growth in online transactions which was 21% over the same period. Shoppers in this age group represent 25% of total online transactions, but just 17% of total online spending.

* These numbers are our best estimates and are based on a representative sample of shoppers who make up approximately 90% of all online shoppers in New Zealand aged 15 and over.