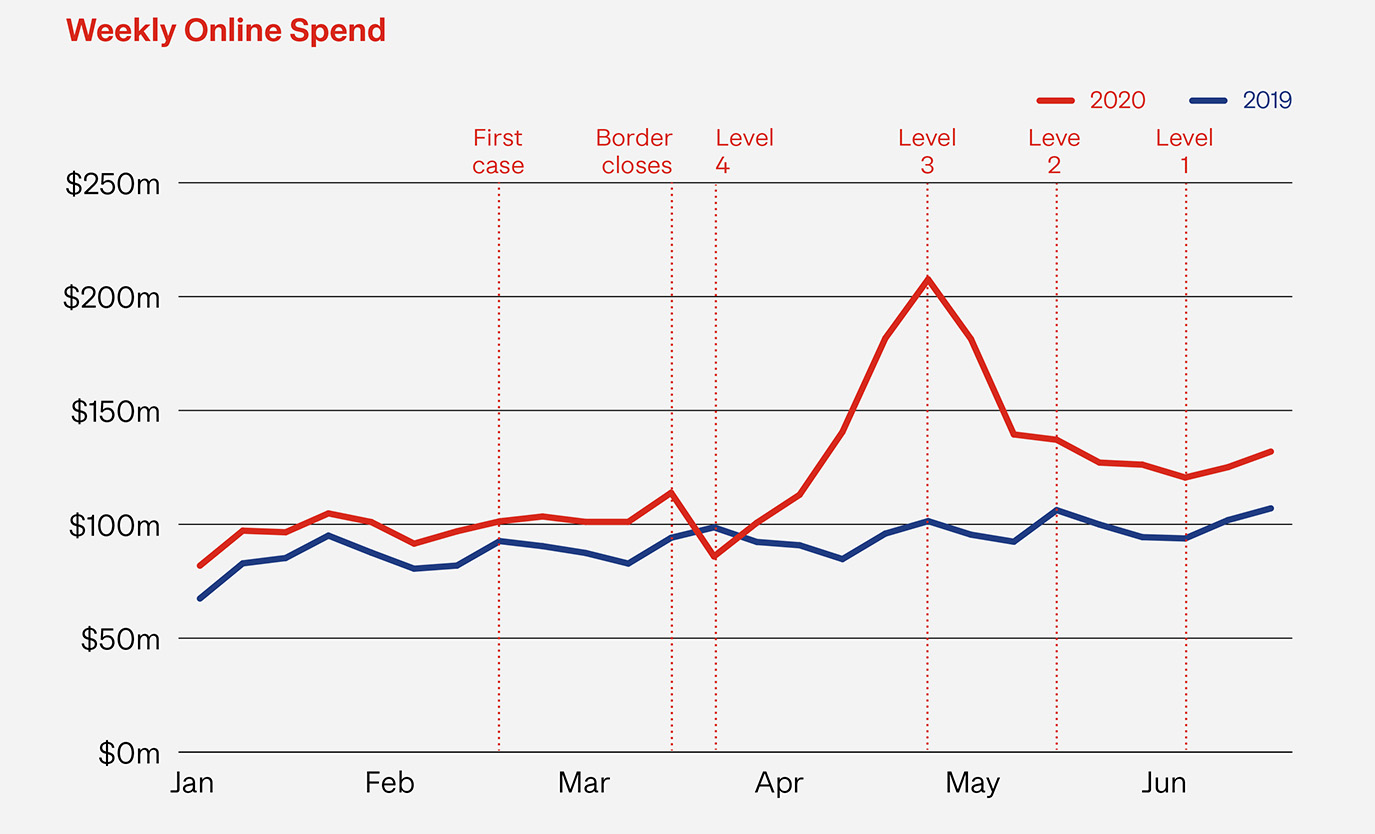

Continuing on from a number of years of online sales growth, 2020 started strong for online retailers, with constant sales growth in the first quarter – despite the growing nervousness around COVID.

After a small decline at the start of lockdown, overall online sales saw a huge increase during Alert Levels 4 and 3.

Online spend peaked in late April as the country moved to Level 3. On that week shoppers could finally have their ‘non-essentials’ purchases delivered, driving spend to 105% of the same week a year earlier. $1 in every $4 spent that week through New Zealand was online!

Total online spend across the whole of Level 3 was 83% up on spend in same period in 2019. As the country returned to work, cafes and in-stores shopping in Levels 2 and 1, sales growth returned to a trajectory well above where it was before lockdown.

Has COVID taken online shopping to a new level? We think so and we’ll continue to track and report on this going forward. The phenomenal growth of online shopping is driven by a strong uplift in all three of the key online measures – number of people shopping online; how often they buy; and how much they spend each time.

For the six months to 30 June (compared to same period in 2019):

30%Higher online spend. | 11.6%Of all retail spend | 71%Of all online spend was |

172kNew first-time | 3.15Online transactions per | $107Average spend per |

In May there were nearly 1.5m Kiwis shopping online, that’s 28% more than in May 2019. Interestingly many of these shoppers came from regional areas like Taranaki, Northland and Gisborne: areas that have traditionally been slower to embrace online shopping. The over 60s segment is another group who grew their numbers online over the last six months. Again, this is a group who, pre-lockdown, weren’t as strongly represented. Females dominate online shopping and we saw more females than males come online in early 2020.

Growth in spend in May 2020 (compared to May 2019):

71%Taranaki, Northland, | 62%Over 60s. | 61%Female shoppers. |

One of the trends Kiwi retailers will be most happy about, over the last six months, has been the continuation of the trend to buy local. While domestic online sales grew by 53%, international sales were down 5% on the same period last year. With the current ‘See NZ. Buy NZ’ sentiment, this is a trend that we expect to see continuing in the months ahead.

Lockdown drove another interesting change in shopping patterns during the week. While Tuesday continues to remain the most popular shopping day, over lockdown we saw the rest of the week evening out. Sundays emerged as the preferred day for online grocery, driving a big increase in weekend numbers. Pre-lockdown online weekend spending across all sectors averaged around $9.6m per day but post-lockdown this number has risen to around $15.6m per day.

At $2.8b, online shopping over the first half of 2020 is 30% above the same period last year. What’s even more astonishing is that over this same six month period overall retail spend declined by 1%, driven by physical retail’s big declines over Levels 4 and 3 when their doors were shut.

The forced necessity of lockdown drove this online growth activity but ongoing convenience, safety concerns and the formation of online shopping habits should see these higher levels continue. Getting your groceries, and other everyday items, online and having them delivered (or click & collect) has become the new norm for many. The opportunity is now for retailers to maintain their new customers and to build on the new, higher and more often, spending habits of their existing ones.