Buy Now Pay Later (BNPL) is everywhere in the online shopping world. BNPL companies like Humm (formerly Oxipay), Afterpay, Laybuy, and Zip are promoting their offering heavily, many through mainstream media. Traditional banks are moving into the space and retailers are using BNPL as a competitive advantage. BNPL has experienced phenomenal growth in the last two years and despite talk of more regulation coming, there’s little to suggest that Kiwi’s attraction to deferred payments will wane. It’s an online trend, retailers just can’t afford to ignore.

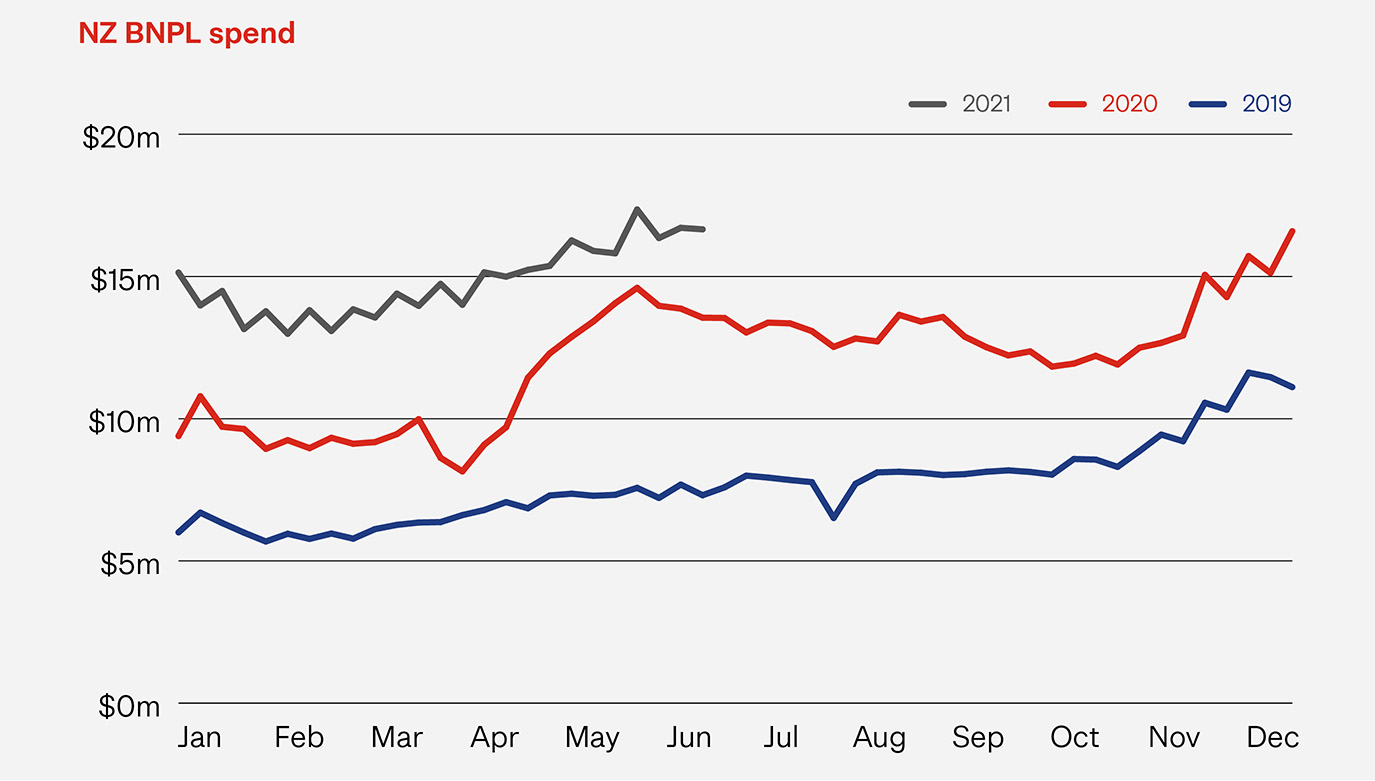

Following 72% growth in spend over 2020, BNPL continues to grow quarter on quarter in 2021. In the second quarter of 2021 (Q2 21) BNPL was 28% up on the same quarter in 2020 and a massive 121% up on the same quarter in 2019. That’s over $15m a week going through BNPL platforms, compared to around $7m in 2019. Around one in every five dollars being spent domestically online is through BNPL.

This hyper-increase over the last two years is driven by growth in all key factors – the number of shoppers using BNPL, how often they use it and how much they spend each time.

Q2 2021 vs Q2 2019

52%Increased |

22%Increased Transactions |

19%Increased Average |

In Q2 21 there were nearly half a million user of BNPL, 170,000 more than two years ago.

While we’ve seen huge growth in numbers there are some things that remain consistent. BNPL is most popular with shoppers aged 45 and under. 37% of shoppers are aged between 15-30 and a further 37% are aged 30-44. Having said that, one in five BNPL shoppers are aged 45-59 and while we are seeing growth in the over 60s, deferring payments is not a habit this group have embraced.

74% of BNPL users are female but interestingly, it’s males signing up that shows the highest growth rate.

BNPL growth is nationwide with almost all regions now spending more than double what did they did two years ago. The big cities lead the way, growing their BNPL spend by 140%, with Auckland spearheading this result. But BNPL isn’t just a big city phenomenon. The West Coast is matching the big boys, up 138% on the second quarter of 2019. Rural BNPL spend overall is an impressive 115% higher than it was two years ago.

In Q2 2021 there were 1.85m BNPL transactions, 850,000 more than two years ago. During Q2 2021 online shoppers as a whole 6.59 transactions. On average shoppers used BNPL 3.7 times through the quarter. This may support the benefits promoted by providers that BNPL encourages shoppers to buy more often.

The average transaction this quarter, across all online shopping, was $108. The average BNPL transaction size was $112, up from $94 two years ago. This could suggest that making it easier for people to pay does drive higher levels of spend.

Interestingly, while Tuesday and Wednesday account for almost a third of all online transaction, for BNPL these two days make up 43% of all transactions.

All sectors, including domestic marketplaces, are benefiting from the growth of BNPL. Not surprising, discretionary spend sectors, like Clothing & Footwear and Department & Variety, as well as sectors characterised by higher priced items, like Homewares, Electronics and Appliances, are seeing the strongest growth in BNPL take-up.

There is a cost for retailers to offer BNPL but for many online retailers, across most sectors, the increase in customers, the additional transactions and the higher level of spend means that this extra cost can be justified. Customers are demanding it and many retailers are seeing this an essential of being an online business. For those retailers who haven’t yet offered this to customers, it may be worth weighing up the pros and cons again. As you do, remember that while the current BNPL trajectory is for more strong growth, the pending introduction of regulation may have a big impact on where this sector goes. The Government have indicated they are considering the need for potential regulation, following similar announcements in Australia and action in the UK.

For now though, BNPL is an online shopping juggernaut retailers ignore at their own peril.